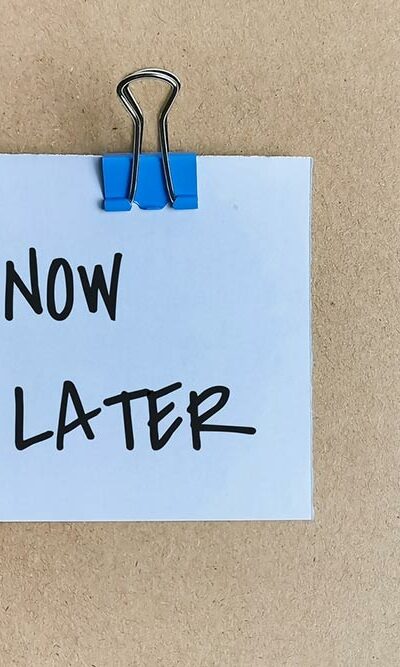

7 mistakes to avoid while using buy now, pay later

Buy now, pay later is one of the latest financing trends, often considered a way of making purchases easier for customers. Here, using a third-party provider, one can make payments on those purchases later. While this may seem quite convenient, the offer comes with its own risks that can result in an unnecessary debt burden. To avoid this, it helps to be wary of the following common buy now, pay later mistakes: 1. Ignoring the fine print This is one of the most common buy now, pay later people tend to make. Here, they may be tempted to skip reviewing the jargon-heavy and complex terms and conditions. However, this can cause more harm than one expects, as the fine print contains all the important guidelines, such as late payment fees, number of installments, payment methods, and other crucial buying information. Checking the terms thoroughly can help one avoid a lot of trouble while using the buy now, pay later (BNPL) payment method. 2. Making too many purchases It is common to develop a false sense of security when accessing the buy now, pay later offer for a purchase. One can end up assuming that they will always have enough funds to pay off dues later. So, they may impulsively overspend on things they may not need. Over time, unchecked spending can add up, making for an unexpectedly large bill. Further, one may incur extra fees and penalties if the bills are not paid on time. Finally, overutilizing the buy now, pay later option can result in an ever-increasing debt, which will put a dent in the credit score. 3. Buying unaffordable things Along with impulsive buying, spending beyond their means is another mistake people make with BNPL. This problem is also common among credit card holders, who may end up buying an otherwise unaffordable big-ticket item with their card and fail to pay back the bill on time.